Damaging Credit History of Homeowner

Unfavorable credit homeowner fundings are developed to aid those with damaging credit reports to get the cash money they require to make house enhancements, consolidate financial obligations, finance an education and learning or make a big acquisition. Also, those with negative credit ratings can get approved for a financing based on the equity in their house.

As home loan and also home mortgage rates are at an all-time low in the United Kingdom, many people are picking to capitalize on the reduced rates of interest to make house enhancements that will substantially include the value of their home. Such renovations consist of conversions as well as additions to an existing residence. As lenders are heavily competing for consumers, a lot of them are discovering it sensible to make loans to those people that, years earlier, would certainly not have actually gotten approved for a home mortgage.

These include people with poor or unfavorable credit scores, those with Region Court judgments versus their name, and those who can not verify their revenue and also are considered a noncondition, or self-certifying. Just because a person has unfavorable credit is no factor they can not choose a competitive price when looking for a house owner finance.

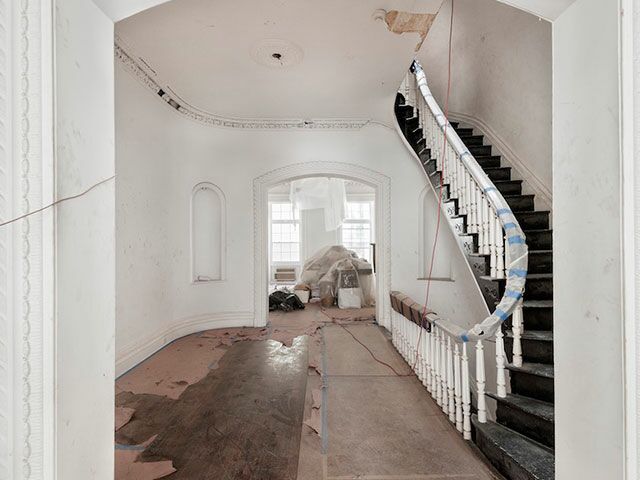

House renovations can include considerably to the worth of one’s residence, in a lot of cases, also doubling the value. These improvements, nevertheless, tend to be rather costly, and also lots of property owners do not have the cash money available for such work. There are many different types of financings readily available to those who wish to do considerable service to their homes. They can be based solely on present house equity, which is the quantity of money the property deserves much less any type of mortgage due, or expected equity, which would certainly be the worth of the house after the improvements less any amount due in the home loans or loans.

Even little residence renovations can be paid for from an adverse credit history of property owner financing. Family appliances, brand-new floor coverings, brand-new windows, or a new roof covering are all examples of small enhancements that are commonly paid for by the use of homeowner finances. These enhancements typically include value to your home along with improving the lifestyle for those living in the house.

Other individuals make an application for damaging VA mortgage lenders to settle the debt. Lots of people end up with damaging credit scores because they have actually merely obtained excessive money on bank cards and also various other unsafe debt. Numerous are locating that because the rate of interest on house owner finances, which are safeguarded against the existing home, is much lower than the prices offered with charge card loans. For this reason, many individuals request a negative credit score homeowner loan to consolidate arrearage and also get one low monthly repayment, instead of several payments that they need to pay every month.

No matter what your scenario, there is a negative debt property owner finance created to match your requirements. Now is the perfect time to borrow cash to do things that you want to do; having adverse debt needs to not stop you from obtaining what you need. To learn more regarding unfavorable credit house owner financings, go to financing tracker today.